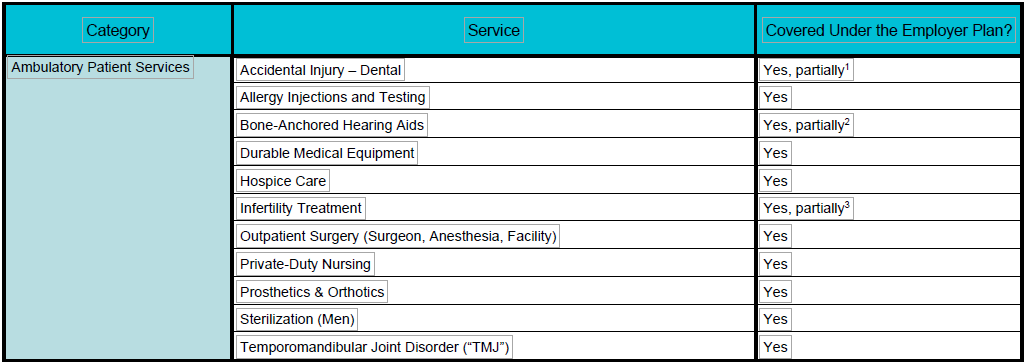

Illinois’ Consumer Coverage Disclosure Act (CCDA): Comparison of Essential Health Benefit Coverage Prepared by ASR Health Benefits

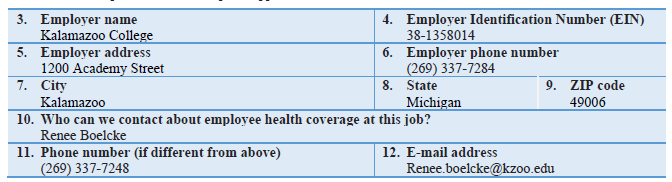

Employer/Plan Administrator: Kalamazoo College, G-1013

Employer State of Situs: Michigan

Employer Plan Name: Health Benefit Plan for Kalamazoo College

Plan Year: January 1, 2025 through December 31, 2025

Premium Assistance under Medicaid and the Children’s Health Insurance Program (CHIP)

If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, your state may have a premium assistance program that can help pay for coverage, using funds from their Medicaid or CHIP programs. If you or your children aren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium assistance programs but you may be able to buy individual insurance coverage through the Health Insurance Marketplace. For more information, visit www.healthcare.gov.

If you or your dependents are already enrolled in Medicaid or CHIP and you live in a state listed below, contact your state Medicaid or CHIP office to find out if premium assistance is available.

If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, contact your state Medicaid or CHIP office or dial 1-877-KIDS NOW or www.insurekidsnow.gov to find out how to apply. If you qualify, ask your state if it has a program that might help you pay the premiums for an employer-sponsored plan.

If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your employer plan, your employer must allow you to enroll in your employer plan if you aren’t already enrolled. This is called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling in your employer plan, contact the Department of Labor at www.askebsa.dol.gov or call 1-866-444-EBSA (3272).

If you live in one of the following states, you may be eligible for assistance paying your employer health plan premiums. The following list of states is current as of July 31, 2024. Contact your state for more information on eligibility.

ALABAMA – Medicaid

Website: http://myalhipp.com/

Phone: 1-855-692-5447

ALASKA – Medicaid

The AK Health Insurance Premium Payment Program

Website:http://myakhipp.com/

Phone: 1-866-251-4861

Email: CustomerService@MyAKHIPP.com

Medicaid Eligibility: https://health.alaska.gov/dpa/Pages/default.aspx

ARKANSAS – Medicaid

Website: http://myarhipp.com/

Phone: 1-855-MyARHIPP (855-692-7447)

CALIFORNIA – Medicaid

Health Insurance Premium Payment (HIPP) Program Website

http://dhcs.ca.gov/hipp

Phone: 916-445-8322

Fax: 916-440-5676

Email: hipp@dhcs.ca.gov

COLORADO – Health First Colorado (Colorado’s Medicaid Program) & Child Health Plan Plus (CHP+)

Health First Colorado Website: https://www.healthfirstcolorado.com/ Health First Colorado Member Contact Center: 1-800-221-3943/

State Relay 711 CHP+: https://hcpf.colorado.gov/child-health-plan-plus

CHP+ Customer Service: 1-800-359-1991/ State Relay 711

Health Insurance Buy-In Program (HIBI): https://www.mycohibi.com/ HIBI Customer Service: 1-855-692-6442

FLORIDA – Medicaid

Website: https://www.flmedicaidtplrecovery.com/

flmedicaidtplrecovery.com/hipp/index.html

Phone: 1-877-357-3268

GEORGIA – Medicaid

GA HIPP Website: https://medicaid.georgia.gov/health-insurance-

premium-payment-program-hipp

Phone: 678-564-1162, Press 1

GA CHIPRA Website: https://medicaid.georgia.gov/programs/

third-party-liability/childrens-health-insurance- program-reauthorization- act-2009-chipra Phone: 678-564-1162, Press 2

INDIANA – Medicaid

Health Insurance Premium Payment Program

All other Medicaid

Website: https://www.in.gov/medicaid/

http://www.in.gov/fssa/dfr/

Family and Social Services Administration

Phone: 1-800-403-0864

Member Services Phone: 1-800-457-4584

IOWA – Medicaid and CHIP (Hawki)

Medicaid Website:

Iowa Medicaid | Health & Human Services

Medicaid Phone: 1-800-338-8366

Hawki Website:

Hawki – Healthy and Well Kids in Iowa | Health & Human Services Hawki Phone: 1-800-257-8563

HIPP Website:

Health Insurance Premium Payment (HIPP) | Health & Human Services (iowa.gov)

HIPP Phone: 1-888-346-9562

KANSAS – Medicaid

Website: https://www.kancare.ks.gov/

Phone: 1-800-792-4884

HIPP Phone: 1-800-967-4660

KENTUCKY – Medicaid

Kentucky Integrated Health Insurance Premium Payment Program

(KI-HIPP) Website: https://chfs.ky.gov/agencies/dms/member/Pages/

kihipp.aspx

Phone: 1-855-459-6328

Email: KIHIPP.PROGRAM@ky.gov

KCHIP Website: https://kynect.ky.gov

Phone: 1-877-524-4718

Kentucky Medicaid Website: https://chfs.ky.gov/agencies/dms

LOUISIANA – Medicaid

Website: www.medicaid.la.gov or www.ldh.la.gov/lahipp

Phone: 1-888-342-6207 (Medicaid hotline) or 1-855-618-5488 (LaHIPP)

MAINE – Medicaid

Enrollment Website: https://www.mymaineconnection.gov/

benefits/s/?language=en_US

Phone: 1-800-442-6003

TTY: Maine relay 711

Private Health Insurance Premium Webpage:

https://www.maine.gov/dhhs/ofi/applications-forms

Phone: 1-800-977-6740

TTY: Maine relay 711

MASSACHUSETTS – Medicaid and CHIP

Website: https://www.mass.gov/masshealth/pa

Phone: 1-800-862-4840

TTY: 711

Email: masspremassistance@accenture.com

MINNESOTA – Medicaid

Website: https://mn.gov/dhs/health-care-coverage/

Phone: 1-800-657-3739

MISSOURI – Medicaid

Website: http://www.dss.mo.gov/mhd/participants/pages/hipp.htm Phone: 573-751-2005

MONTANA – Medicaid

Website: http://dphhs.mt.gov/MontanaHealthcarePrograms/HIPP Phone: 1-800-694-3084

Email: HHSHIPPProgram@mt.gov

NEBRASKA – Medicaid

Website: http://www.ACCESSNebraska.ne.gov

Phone: 1-855-632-7633

Lincoln: 402-473-7000

Omaha: 402-595-1178

NEVADA – Medicaid

Medicaid Website: http://dhcfp.nv.gov

Medicaid Phone: 1-800-992-0900

NEW HAMPSHIRE – Medicaid

Website: https://www.dhhs.nh.gov/programs-services/medicaid/health-

insurance-premium-program

Phone: 603-271-5218

Toll free number for the HIPP program: 1-800-852-3345, ext. 15218 Email: DHHS.ThirdPartyLiabi@dhhs.nh.gov

NEW JERSEY – Medicaid and CHIP

Medicaid Website: http://www.state.nj.us/humanservices/dmahs/clients/

medicaid/

Phone: 1-800-356-1561

CHIP Premium Assistance Phone: 609-631-2392

CHIP Website: http://www.njfamilycare.org/index.html

CHIP Phone: 1-800-701-0710 (TTY: 711)

NEW YORK – Medicaid

Website: https://www.health.ny.gov/health_care/medicaid/

Phone: 1-800-541-2831

NORTH CAROLINA – Medicaid

Website: https://medicaid.ncdhhs.gov/

Phone: 919-855-4100

NORTH DAKOTA – Medicaid

Website: https://www.hhs.nd.gov/healthcare

Phone: 1-844-854-4825

OKLAHOMA – Medicaid and CHIP

Website: http://www.insureoklahoma.org

Phone: 1-888-365-3742

OREGON – Medicaid and CHIP

Website: http://healthcare.oregon.gov/Pages/index.aspx

Phone: 1-800-699-9075

PENNSYLVANIA – Medicaid and CHIP

Website: https://www.pa.gov/en/services/dhs/apply-for-medicaid-health-insurance-premium-payment-program-hipp.html

Phone: 1-800-692-7462

CHIP Website: Children’s Health Insurance Program (CHIP) (pa.gov) CHIP Phone: 1-800-986-KIDS (5437)

RHODE ISLAND – Medicaid and CHIP

Website: http://www.eohhs.ri.gov/

Phone: 1-855-697-4347, or 401-462-0311 (Direct RIte Share Line)

SOUTH CAROLINA – Medicaid

Website: https://www.scdhhs.gov

Phone: 1-888-549-0820

SOUTH DAKOTA – Medicaid

Website: http://dss.sd.gov

Phone: 1-888-828-0059

TEXAS – Medicaid

Website: Health Insurance Premium Payment (HIPP) Program | Texas

Health and Human Services

Phone: 1-800-440-0493

UTAH – Medicaid and CHIP

Utah’s Premium Partnership for Health Insurance (UPP) Website:

https://medicaid.utah.gov/upp/

Email: upp@utah.gov

Phone: 1-888-222-2542

Adult Expansion Website: https://medicaid.utah.gov/expansion/

Utah Medicaid Buyout Program Website:

https://medicaid.utah.gov/buyout-program/

CHIP Website: https://chip.utah.gov/

VERMONT – Medicaid

Website: Health Insurance Premium Payment (HIPP) Program |

Department of Vermont Health Access

Phone: 1-800-250-8427

VIRGINIA – Medicaid and CHIP

Websites: https://coverva.dmas.virginia.gov/learn/premium-assistance/famis-select

https://coverva.dmas.virginia.gov/learn/premium-assistance/ health-insurance-premium-payment-hipp-programs

Medicaid/CHIP Phone: 1-800-432-5924

WASHINGTON – Medicaid

Website: https://www.hca.wa.gov/

Phone: 1-800-562-3022

WEST VIRGINIA – Medicaid and CHIP

Website: https://dhhr.wv.gov/bms/

http://mywvhipp.com/

Medicaid Phone: 304-558-1700

CHIP Toll-free phone: 1-855-MyWVHIPP (1-855-699-8447)

WISCONSIN – Medicaid and CHIP

Website: https://www.dhs.wisconsin.gov/badgercareplus/p-10095.htm Phone: 1-800-362-3002

WYOMING – Medicaid

Website: https://health.wyo.gov/healthcarefin/medicaid/programs-and-

eligibility/

Phone: 1-800-251-1269

To see if any other states have added a premium assistance program since July 31, 2024, or for more information on special enrollment rights, contact either:

U.S. Department of Labor

Employee Benefits Security Administration

1-866-444-EBSA (3272)

U.S. Department of Health and Human Services Centers for Medicare & Medicaid Services

www.cms.hhs.gov

1-877-267-2323, Menu Option 4, Ext. 61565

Paperwork Reduction Act Statement

According to the Paperwork Reduction Act of 1995 (Pub. L. 104-13) (PRA), no persons are required to respond to a collection of information unless such collection displays a valid Office of Management and Budget (OMB) control number. The Department notes that a Federal agency cannot conduct or sponsor a collection of information unless it is approved by OMB under the PRA, and displays a currently valid OMB control number, and the public is not required to respond to a collection of information unless it displays a currently valid OMB control number. See 44 U.S.C. 3507. Also, notwithstanding any other provisions of law, no person shall be subject to penalty for failing to comply with a collection of information if the collection of information does not display a currently valid OMB control number. See 44 U.S.C. 3512.

The public reporting burden for this collection of information is estimated to average approximately seven minutes per respondent. Interested parties are encouraged to send comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the U.S. Department of Labor, Employee Benefits Security Administration, Office of Policy and Research, Attention: PRA Clearance Officer, 200 Constitution Avenue, N.W., Room N-5718, Washington, DC 20210 or email ebsa.opr@dol.gov and reference the OMB Control Number 1210-0137.

Health Insurance Marketplace Coverage Options and Your Health Coverage

PART A: General Information

Even if you are offered health coverage through your employment, you may have other coverage options through the Health Insurance Marketplace (“Marketplace”). To assist you as you evaluate options for you and your family, this notice provides some basic information about the Health Insurance Marketplace and health coverage offered through your employment.

What is the Health Insurance Marketplace?

The Marketplace is designed to help you find health insurance that meets your needs and fits your budget. The Marketplace offers “one-stop shopping” to find and compare private health insurance options in your geographic area.

Can I Save Money on my Health Insurance Premiums in the Marketplace?

You may qualify to save money and lower your monthly premium and other out-of-pocket costs, but only if your employer does not offer coverage, or offers coverage that is not considered affordable for you and doesn’t meet certain minimum-value standards (discussed below). The savings that you’re eligible for depends on your household income. You may also be eligible for a tax credit that lowers your costs.

Does Employment-Based Health Coverage Affect Eligibility for Premium Savings through the Marketplace?

Yes. If you have an offer of health coverage from your employer that is considered affordable for you and meets certain minimum-value standards, you will not be eligible for a tax credit, or advance payment of the tax credit, for your Marketplace coverage and may wish to enroll in your employment-based health plan. However, you may be eligible for a tax credit, and advance payments of the credit that lowers your monthly premium, or a reduction in certain cost-sharing, if your employer does not offer coverage to you at all or does not offer coverage that is considered affordable for you or meet minimum-value standards. If your share of the premium cost of all plans offered to you through your employment is more than 9.12%1 of your annual household income, or if the coverage through your employment does not meet the “minimum-value” standard set by the Affordable Care Act, you may be eligible for a tax credit, and advance payment of the credit, if you do not enroll in the employment-based health coverage. For family members of the employee, coverage is considered affordable if the employee’s cost of premiums for the lowest-cost plan that would cover all family members does not exceed 9.12% of the employee’s household income.2

Note: If you purchase a health plan through the Marketplace instead of accepting health coverage offered through your employment, then you may lose access to whatever the employer contributes to the employment-based coverage. Also, this employer contribution -as well as your employee contribution to employment-based coverage- is generally excluded from income for federal and state income tax purposes. Your payments for coverage through the Marketplace are made on an after-tax basis. In addition, note that if the health coverage offered through your employment does not meet the affordability or minimum-value standards, but you accept that coverage anyway, you will not be eligible for a tax credit. You should consider all of these factors in determining whether to purchase a health plan through the Marketplace.

When Can I Enroll in Health Insurance Coverage through the Marketplace?

You can enroll in a Marketplace health insurance plan during the annual Marketplace Open Enrollment Period. Open Enrollment varies by state but generally starts November 1 and continues through at least December 15.

Outside the annual Open Enrollment Period, you can sign up for health insurance if you qualify for a Special Enrollment Period. In general, you qualify for a Special Enrollment Period if you’ve had certain qualifying life events, such as getting married, having a baby, adopting a child, or losing eligibility for other health coverage. Depending on your Special Enrollment Period type, you may have 60 days before or 60 days following the qualifying life event to enroll in a Marketplace plan.

There is also a Marketplace Special Enrollment Period for individuals and their families who lose eligibility for Medicaid or Children’s Health Insurance Program (CHIP) coverage on or after March 31, 2023, through July 31, 2024. Since the onset of the nationwide COVID-19 public health emergency, state Medicaid and CHIP agencies generally have not terminated the enrollment of any Medicaid or CHIP beneficiary who was enrolled on or after March 18, 2020, through March 31, 2023. As state Medicaid and CHIP agencies resume regular eligibility and enrollment practices, many individuals may no longer be eligible for Medicaid or CHIP coverage starting as early as March 31, 2023. The U.S. Department of Health and Human Services is offering a temporary Marketplace Special Enrollment period to allow these individuals to enroll in Marketplace coverage.

Marketplace-eligible individuals who live in states served by HealthCare.gov and either- submit a new application or update an existing application on HealthCare.gov between March 31, 2023 and July 31, 2024, and attest to a termination date of Medicaid or CHIP coverage within the same time period, are eligible for a 60-day Special Enrollment Period. That means that if you lose Medicaid or CHIP coverage between March 31, 2023, and July 31, 2024, you may be able to enroll in Marketplace coverage within 60 days of when you lost Medicaid or CHIP coverage. In addition, if you or your family members are enrolled in Medicaid or CHIP coverage, it is important to make sure that your contact information is up to date to make sure you get any information about changes to your eligibility. To learn more, visit HealthCare.gov or call the Marketplace Call Center at 1-800-318-2596. TTY users can call 1-855-889-4325.

What about Alternatives to Marketplace Health Insurance Coverage?

If you or your family are eligible for coverage in an employment-based health plan (such as an employer-sponsored health plan), you or your family may also be eligible for a Special Enrollment Period to enroll in that health plan in certain circumstances, including if you or your dependents were enrolled in Medicaid or CHIP coverage and lost that coverage. Generally, you have 60 days after the loss of Medicaid or CHIP coverage to enroll in an employment-based health plan, but if you and your family lost eligibility for Medicaid or CHIP coverage between March 31, 2023 and July 10, 2023, you can request this special enrollment in the employment-based health plan through September 8, 2023. Confirm the deadline with your employer or your employment-based health plan.

Alternatively, you can enroll in Medicaid or CHIP coverage at any time by filling out an application through the Marketplace or applying directly through your state Medicaid agency. Visit https://www.healthcare.gov/medicaid-chip/getting-medicaid-chip/ for more details.

How Can I Get More Information?

For more information about your coverage offered by your employer, please check your health plan’s summary plan description or contact ASR Health Benefits at (800) 968-2449.

The Marketplace can help you evaluate your coverage options, including your eligibility for coverage through the Marketplace and its cost. Please visit HealthCare.gov for more information, including an online application for health insurance coverage and contact information for a Health Insurance Marketplace in your area.

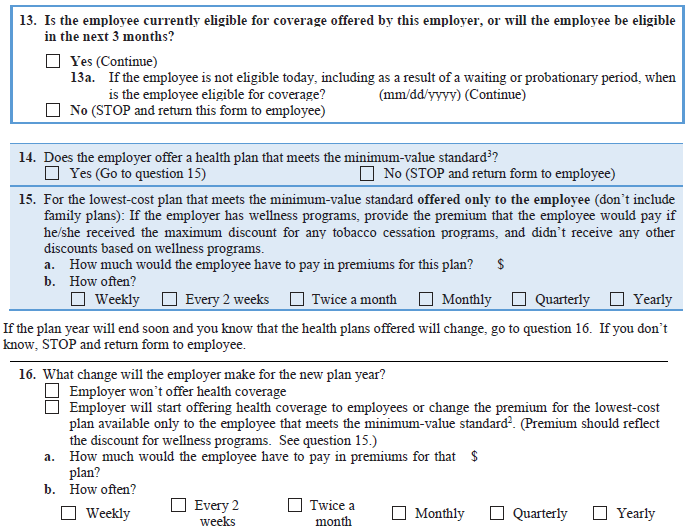

PART B: Information About Health Coverage Offered by Your Employer

This section contains information about any health coverage offered by your employer. If you decide to complete an application for coverage in the Marketplace, you will be asked to provide this information. This information is numbered to correspond to the Marketplace application.

Marketplace Application

Basic Information

Here is some basic information about health coverage offered by this employer:

- As your employer, we offer a health plan to: Some employees. Eligible employees are:

- Individuals working in full-time employment for at least 40 hours or more per week or part-time employment for at least 20 hours or more per week. Such individuals must complete any required waiting period for plan coverage and must submit any required application for health plan coverage on a form that is acceptable to the employer.

- With respect to dependents: We do offer coverage. Eligible dependents are:

- The employee’s legal spouse. However, working spouses with other available employer-basedcoverage are generally not eligible to enroll for coverage under the plan (an exception based onthe spouse’s share of the premium cost may apply).

- The employee’s domestic partner (some restrictions apply). However, working domesticpartners with other available employer-based coverage are generally not eligible to enroll forcoverage under the plan (an exception based on the domestic partner’s share of the premiumcost may apply).

- The employee’s or enrolled domestic partner’s natural child, stepchild, legally adopted child,or a child placed with the employee or domestic partner for adoption (age limits apply).

- A child who has been placed under the legal guardianship of the employee or enrolled domesticpartner and is considered a “dependent” of the employee or domestic partner for tax exemptionpurposes under Section 152 of the Internal Revenue Code of 1986, as amended (age limitsapply).

- A child for whom the employee or enrolled domestic partner is obligated to provide medicalcare coverage under an order or judgment of a court of competent jurisdiction and could beconsidered a “dependent” of the employee for tax exemption purposes under Section 152 of theInternal Revenue Code of 1986, as amended (age limits apply).

- A child for whom the employee or enrolled domestic partner is obligated to provide medicalcoverage under a Qualified Medical Child Support Order (age limits apply).

- If checked, this coverage meets the minimum-value standard, and the cost of this coverage to you is intended to be affordable, based on employee wages.

Even if your employer intends your coverage to be affordable, you may still be eligible for a premium discount through the Marketplace. The Marketplace will use your household income, along with other factors, to determine whether you may be eligible for a premium discount. If, for example, your wages vary from week to week (perhaps you are an hourly employee or you work on a commission basis), if you are newly employed mid-year, or if you have other income losses, you may still qualify for a premium discount.

If you decide to shop for coverage in the Marketplace, HealthCare.gov will guide you through the process. Here’s the employer information you’ll enter when you visit HealthCare.gov to find out if you can get a tax credit to lower your monthly premiums.

The information below corresponds to the Marketplace Employer Coverage Tool. Completing this section is optional for employers, but will help ensure employees understand their coverage choices.

Notice to Plan Participants – HIPAA Special Enrollment Rights

If you are declining enrollment for yourself or your dependents (including your spouse) because of other health insurance or group health plan coverage, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage (or if the employer stops contributing toward your or your dependents’ other coverage).

In general, you must request enrollment within 30 days after your or your dependents’ other coverage ends (or after the employer stops contributing toward the other coverage). However, if you or your dependents lose coverage under Medicaid or a state’s Children Health Insurance Program (CHIP), or if you or your dependents become eligible for a premium-assistance subsidy under Medicaid or a CHIP, you have 60 days from the loss of coverage or the date of eligibility to request enrollment. In addition, if you acquire a new dependent as a result of marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your dependents in this plan. However, you must request enrollment within 30 days after the marriage, birth, adoption, or placement for adoption. To request special enrollment or obtain more information, contact ASR Health Benefits at (616) 957-1751 or (800) 968-2449.

Women’s Health and Cancer Rights Act of 1998 (Also Known As Janet’s Law)

Did you know that your health plan, as required by the Women’s Health and Cancer Rights Act of 1998, provides benefits for mastectomy-related services? These services include reconstruction and surgery to achieve symmetry between the breasts, prostheses, and treatment of complications resulting from a mastectomy (including lymphedema). Call your Claim Administrator at (616) 957-1751 or 1-800-968-2449 for more information.

NOTICE: USERRA Uniformed Services Employment and Reemployment Rights Act

Your right to continued participation in the Plan during leaves of absence for active military duty is protected by the Uniformed Services Employment and Reemployment Rights Act (USERRA). Accordingly, if you are absent from work due to a period of active duty in the military for less than 31 days, your Plan participation will not be interrupted. If the absence is for more than 31 days and not more than 12 weeks, you may continue to maintain your coverage under the Plan by paying the premium. If you do not elect to continue to participate in the Plan during an absence for military duty that is more than 31 days, or if you revoke a prior election to continue to participate for up to 12 weeks after your military leave began, you and your covered family members will have the opportunity to elect COBRA Continuation Coverage only under the medical insurance policy for the 24-month period (18-month period if you elected coverage prior to December 10, 2004) that begins on the first day of your leave of absence. You must pay the premiums for Continuation Coverage with after-tax funds, subject to the rules that are set out in that plan.

Notice of Qualified Health Coverage for Purposes of Michigan No-Fault Auto Law

(Michigan Residents Only)

This Notice contains important information that you’ll need to know when you purchase or renew an auto insurance policy in the State of Michigan. You should show this Notice to your auto insurance agent so that he or she can help you construct a policy that meets your needs.

Under Michigan no-fault auto law, when you purchase or renew your auto insurance policy after July 1, 2020 you won’t automatically receive unlimited, lifetime Personal Insurance Protection (PIP) medical coverage. Instead, you’ll be able to choose from a menu of PIP medical coverage levels. Your auto insurance agent will be able to explain the pros and cons of each one. When considering how much PIP medical coverage to purchase, it’s critical to keep these points in mind:

• Kalamazoo College’s health plan (the “Plan”) pays primary on Michigan enrollees’ auto-related claims, and given current deductible requirements constitutes

“qualified health coverage” as defined in Michigan Compiled Laws 500.3107d(7)(b)(i).

• Coverage of auto accident-related claims under any employment-based plan is available only as long as you remain employed/enrolled AND that plan continues to cover Michigan enrollees’ auto claims. In contrast, the amount of PIP medical coverage on your policy at the time of an auto accident remains available to you until the maximum payout per accident (if any) is exhausted, no matter how long that takes.

• Most types of care are covered under both the Plan and PIP medical. However, PIP medical covers additional services that employment-based plans typically do not. Your auto insurance agent can explain what those services are.

You’re urged to carry enough PIP coverage on your auto policy to protect yourself and your family from financial catastrophe in the event that there are claims for auto accident-related services that the Plan doesn’t cover, or if you or any of your family members cease to be enrolled in the Plan.

Contact your auto insurance agent immediately if you or any of your family members cease to be enrolled in the Plan, or if the Plan ceases to constitute “qualified health coverage.” An adjustment to your auto policy may be required, and you may have a limited amount of time to make it.

NOTE: This notice is correct at the time of this writing but may not reflect recent changes to plan coverage. For more information, call ASR Health Benefits at (616) 957-1751 or (800) 968-2449.

CMS Creditable Coverage Disclosure Notice – Important Notice from Kalamazoo College About Your Prescription Drug Coverage and Medicare

This Notice affects individuals who are enrolled in or eligible to enroll in Medicare. You or a family member may be enrolled in Medicare owing to age (on or after attaining age 65), a disability, or permanent kidney failure (end-stage renal disease). If no one in your family is enrolled in or eligible to enroll in Medicare, the information in this Notice does NOT apply to you.

This Notice provides information about your current prescription drug coverage under the Health Benefit Plan offered by Kalamazoo College (Employer) and the prescription drug coverage for people with Medicare. You may receive this Notice or an updated version of this Notice on an annual basis. You may also request an additional copy of this Notice at any time.

For further information about this Notice or your coverage under the Health Benefit Plan, you may contact Employer at the following address or telephone number:

Kalamazoo College

Renee Boelcke

1200 Academy Street

Kalamazoo, Michigan 49006

(269) 337-7248

If this Notice applies to you or a family member, you should read it carefully and keep it where you can find it.

Information You Need to Know about Medicare Prescription Drug Coverage

- Medicare prescription drug coverage became available in 2006 to everyone who is eligible for Medicare. You can get this coverage if you join a Medicare prescription drug plan or a Medicare Advantage plan (like an HMO or PPO) that offers prescription drug coverage.

- You can join a Medicare prescription drug plan or Medicare Advantage plan when you first become eligible for Medicare and each year from October 15 through December 7. In addition, if you lose coverage through Employer through no fault of your own, you will be eligible to sign up for a Medicare prescription drug plan at that time, through a special two-month enrollment period.

- All Medicare prescription drug plans provide at least a standard level of coverage set by Medicare. Some plans may also offer more coverage for a higher monthly premium. Medicare beneficiaries will need to carefully review the materials provided by each prescription drug plan available to them to determine whether it provides the coverage they need.

Information You Need to Know about Employer’s Prescription Drug Coverage

- Employer currently offers eligible employees and their eligible dependents prescription drug coverage under the Health Benefit Plan. Participants in the Health Benefit Plan who are enrolled in, or eligible for, Medicare can continue their coverage under the Health Benefit Plan.

- Employer has determined that the prescription drug coverage offered under the Health Benefit Plan is, on average for all plan participants, expected to pay as much as the standard Medicare prescription drug coverage will pay. In other words, for most people, the prescription drug coverage under the Health Benefit Plan is at least as good as the coverage you can get from a Medicare prescription drug plan, which means this coverage is “creditable coverage.” As a result, participants in the Health Benefit Plan who are also enrolled in or eligible to enroll in Medicare can keep their current coverage under the Health Benefit Plan and not pay a higher premium if they later decide to enroll in a Medicare prescription drug plan.

Frequently Asked Questions (FAQ)

Please take a moment to review the FAQ section and reach out to HR.Benefits@kzoo.edu with any questions or concerns.

If I decide to enroll in a Medicare prescription drug plan, can I also keep my coverage under the Health Benefit Plan?

Yes. Enrollment in a Medicare prescription drug plan will generally not affect your eligibility for coverage under the Health Benefit Plan. However, as long as you are actively working for Employer, coverage under the Health Benefit Plan will usually be your primary coverage. Therefore, you may not need to enroll in a Medicare prescription drug plan while you are actively working for Employer.

If I decide to drop my coverage under the Health Benefit Plan and enroll in a Medicare prescription drug plan and Medicare Parts A and B, can I re-enroll in the Health Benefit Plan if I later decide I do not like the Medicare plan?

Yes. However, if you drop coverage under the Health Benefit Plan, you will generally not be able to re-enroll until the next open enrollment period.

Before dropping coverage under the Health Benefit Plan, you should consider that your coverage under the Health Benefit Plan pays for other health expenses in addition to prescription drugs, which may or may not be covered under Medicare Parts A and B and the Medicare prescription drug coverage to the same extent that they are covered under the Health Benefit Plan.

You should compare your current coverage under the Health Benefit Plan with the coverage and cost of the Medicare prescription drug coverage plans providing coverage in your area (and Medicare Parts A and B) before deciding whether to drop coverage under the Health Benefit Plan.

What happens if I elect to keep my coverage under the Health Benefit Plan and not enroll in Medicare prescription drug coverage until I leave Employer?

Because the prescription drug coverage under the Health Benefit Plan is, on average for all plan participants, expected to pay as much as the standard Medicare prescription drug coverage will pay, it is considered “creditable coverage.” As a result, you can choose to join a Medicare prescription drug plan later without paying a higher premium (a penalty).

Each year, Medicare beneficiaries will have the opportunity to enroll in a Medicare prescription drug plan between October 15 and December 7. You will also be entitled to a special two-month enrollment period if your coverage under the Health Benefit Plan ends through no fault of your own. However, individuals who drop or lose coverage under the Health Benefit Plan but do not enroll in Medicare prescription drug coverage within a certain period of time may pay more to enroll in Medicare prescription drug coverage later.

If you go 63 continuous days or longer without prescription drug coverage that is at least as good as Medicare’s prescription drug coverage (i.e., creditable coverage), your monthly premium may increase by at least 1 percent of the Medicare base premium per month for every month that you did not have creditable coverage. For example, if you go 19 months without creditable coverage, your premium will always be at least 19 percent higher than the Medicare base premium. You may pay this higher premium (a penalty) as long as you have Medicare coverage. In addition, you may have to wait until the next October to enroll.

Where can I get more information about my options under Medicare prescription drug coverage?

More detailed information about Medicare plans that offer prescription drug coverage will be available in the “Medicare & You” handbook. Medicare beneficiaries will get a copy of the handbook in the mail every year from Medicare; representatives from Medicare prescription drug plans may also contact beneficiaries directly. More information about Medicare prescription drug plans is also available as follows:

- Visit www.medicare.gov.

- Call your State Health Insurance Assistance Program (see your copy of the “Medicare & You” handbook for the telephone number).

- Call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048.

If you have limited income and resources, extra help paying for a Medicare prescription drug plan is available. For information about this extra help, visit the Social Security Administration online at www.socialsecurity.gov, or call them at 1-800-772-1213 (TTY 1-800-325-0778).

Remember: Keep this Notice. If you decide to enroll in a Medicare prescription drug plan, you may be required to provide a copy of this Notice when you join to show whether you have maintained creditable coverage and whether you are required to pay a higher premium (a penalty).

CMS Creditable Coverage Disclosure Notice for Retirees – Important Notice from Kalamazoo College About Your Prescription Drug Coverage and Medicare

This Notice affects individuals who are enrolled in or eligible to enroll in Medicare. You or a family member may be enrolled in Medicare owing to age (on or after attaining age 65), a disability, or permanent kidney failure (end-stage renal disease). If no one in your family is enrolled in or eligible to enroll in Medicare, the information in this Notice does NOT apply to you.

This Notice provides information about your current retiree prescription drug coverage under the Health Benefit Plan offered by Kalamazoo College (Employer) and the prescription drug coverage for people with Medicare. You may receive this Notice or an updated version of this Notice on an annual basis. You may also request an additional copy of this Notice at any time.

For further information about this Notice or your retiree coverage under the Health Benefit Plan, you may contact Employer at the following address or telephone number:

Kalamazoo College

Renee Boelcke

1200 Academy Street

Kalamazoo, Michigan 49006

(269) 337-7248

If this Notice applies to you or a family member, you should read it carefully and keep it where you can find it.

Information You Need to Know about Medicare Prescription Drug Coverage

- Medicare prescription drug coverage became available in 2006 to everyone who is eligible for Medicare. You can get this coverage if you join a Medicare prescription drug plan or a Medicare Advantage plan (like an HMO or PPO) that offers prescription drug coverage.

- You can join a Medicare prescription drug plan or Medicare Advantage plan when you first become eligible for Medicare and each year from October 15 through December 7. In addition, if you lose coverage through Employer through no fault of your own, you will be eligible to sign up for a Medicare prescription drug plan at that time, through a special two-month enrollment period.

- All Medicare prescription drug plans provide at least a standard level of coverage set by Medicare. Some plans may also offer more coverage for a higher monthly premium. Medicare beneficiaries will need to carefully review the materials provided by each prescription drug plan available to them to determine whether it provides the coverage they need.

Information You Need to Know about Employer’s Prescription Drug Coverage

- Employer currently offers eligible employees and their eligible dependents prescription drug coverage under the Health Benefit Plan. Participants in the Health Benefit Plan who are enrolled in, or eligible for, Medicare can continue their coverage under the Health Benefit Plan.

- Employer has determined that the prescription drug coverage offered under the Health Benefit Plan is, on average for all plan participants, expected to pay as much as the standard Medicare prescription drug coverage will pay. In other words, for most people, the prescription drug coverage under the Health Benefit Plan is at least as good as the coverage you can get from a Medicare prescription drug plan, which means this coverage is “creditable coverage.” As a result, participants in the Health Benefit Plan who are also enrolled in or eligible to enroll in Medicare can keep their current coverage under the Health Benefit Plan and not pay a higher premium if they later decide to enroll in a Medicare prescription drug plan.

Frequently Asked Questions (FAQ)

Please take a moment to review the FAQ section and reach out to HR.Benefits@kzoo.edu with any questions or concerns.

If I decide to enroll in a Medicare prescription drug plan, can I also keep my coverage under the Health Benefit Plan?

Yes. Enrollment in a Medicare prescription drug plan will generally not affect your eligibility for coverage under the Health Benefit Plan. However, as long as you are actively working for Employer, coverage under the Health Benefit Plan will usually be your primary coverage. Therefore, you may not need to enroll in a Medicare prescription drug plan while you are actively working for Employer.

If I decide to drop my coverage under the Health Benefit Plan and enroll in a Medicare prescription drug plan and Medicare Parts A and B, can I re-enroll in the Health Benefit Plan if I later decide I do not like the Medicare plan?

Yes. However, if you drop coverage under the Health Benefit Plan, you will generally not be able to re-enroll until the next open enrollment period.

Before dropping coverage under the Health Benefit Plan, you should consider that your coverage under the Health Benefit Plan pays for other health expenses in addition to prescription drugs, which may or may not be covered under Medicare Parts A and B and the Medicare prescription drug coverage to the same extent that they are covered under the Health Benefit Plan.

You should compare your current coverage under the Health Benefit Plan with the coverage and cost of the Medicare prescription drug coverage plans providing coverage in your area (and Medicare Parts A and B) before deciding whether to drop coverage under the Health Benefit Plan.

What happens if I elect to keep my coverage under the Health Benefit Plan and not enroll in Medicare prescription drug coverage until I leave Employer?

Because the prescription drug coverage under the Health Benefit Plan is, on average for all plan participants, expected to pay as much as the standard Medicare prescription drug coverage will pay, it is considered “creditable coverage.” As a result, you can choose to join a Medicare prescription drug plan later without paying a higher premium (a penalty).

Each year, Medicare beneficiaries will have the opportunity to enroll in a Medicare prescription drug plan between October 15 and December 7. You will also be entitled to a special two-month enrollment period if your coverage under the Health Benefit Plan ends through no fault of your own. However, individuals who drop or lose coverage under the Health Benefit Plan but do not enroll in Medicare prescription drug coverage within a certain period of time may pay more to enroll in Medicare prescription drug coverage later.

If you go 63 continuous days or longer without prescription drug coverage that is at least as good as Medicare’s prescription drug coverage (i.e., creditable coverage), your monthly premium may increase by at least 1 percent of the Medicare base premium per month for every month that you did not have creditable coverage. For example, if you go 19 months without creditable coverage, your premium will always be at least 19 percent higher than the Medicare base premium. You may pay this higher premium (a penalty) as long as you have Medicare coverage. In addition, you may have to wait until the next October to enroll.

Where can I get more information about my options under Medicare prescription drug coverage?

More detailed information about Medicare plans that offer prescription drug coverage will be available in the “Medicare & You” handbook. Medicare beneficiaries will get a copy of the handbook in the mail every year from Medicare; representatives from Medicare prescription drug plans may also contact beneficiaries directly. More information about Medicare prescription drug plans is also available as follows:

- Visit www.medicare.gov.

- Call your State Health Insurance Assistance Program (see your copy of the “Medicare & You” handbook for the telephone number).

- Call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048.

- If you have limited income and resources, extra help paying for a Medicare prescription drug plan is available. For information about this extra help, visit the Social Security Administration online at www.socialsecurity.gov, or call them at 1-800-772-1213 (TTY 1-800-325-0778).

Remember: Keep this Notice. If you decide to enroll in a Medicare prescription drug plan, you may be required to provide a copy of this Notice when you join to show whether you have maintained creditable coverage and whether you are required to pay a higher premium (a penalty)

Glossary of Health Coverage and Medical Terms

This glossary defines many commonly used terms, but isn’t a full list. These glossary terms and definitions are intended to be educational and may be different from the terms and definitions in your plan or health insurance policy. Some of these terms also might not have exactly the same meaning when used in your policy or plan, and in any case, the policy or plan governs. (See your Summary of Benefits and Coverage for information on how to get a copy of your policy or plan document.)

- Underlined text indicates a term defined in this Glossary.

- See below for an example showing how deductibles, coinsurance and out-of-pocket limits work

together in a real life situation.

Allowed Amount

This is the maximum payment the plan will pay for a covered health care service. May also be called “eligible expense,” “payment allowance,” or “negotiated rate.”

Appeal

A request that your health insurer or plan review a decision that denies a benefit or payment (either in whole or in part).

Balance Billing

When a provider bills you for the balance remaining on the bill that your plan doesn’t cover. This amount is the difference between the actual billed amount and the allowed amount. For example, if the provider’s charge is $200 and the allowed amount is $110, the provider may bill you for the remaining $90. This happens most often when you see an out-of-network provider (non-preferred provider). A network provider (preferred provider) may not bill you for covered services.

Claim

A request for a benefit (including reimbursement of a health care expense) made by you or your health care provider to your health insurer or plan for items or services you think are covered.

Coinsurance

Your share of the costs of a covered health care service, calculated as a percentage (for example, 20%) of the allowed amount for the service. You generally pay coinsurance plus any deductibles may owe. (For example, if the health insurance or plan’s allowed amount for an office visit is $100 and you’ve met your deductible, your coinsurance payment of 20% would be $20. The health insurance or plan pays the rest of the allowed amount.)

Complications of Pregnancy

Conditions due to pregnancy, labor, and delivery that require medical care to prevent serious harm to the health of the mother or the fetus. Morning sickness and a non-emergency caesarean section generally aren’t complications of pregnancy.

Copayment

A fixed amount (for example, $15) you pay for a covered health care service, usually when you receive the service sometimes called “copay”). The amount can vary by the type of covered health care service.

Cost Sharing

Your share of costs for services that a plan covers that you must pay out of your own pocket (sometimes called “out-of-pocket costs”). Some examples of cost sharing are copayments, deductibles, and coinsurance. Family cost sharing is the share of cost for deductibles and out-of-pocket costs you and your spouse and/or child(ren) must pay out of your own pocket. Other costs, including your premiums, penalties you may have to pay, or the cost of care a plan doesn’t cover usually aren’t considered

Cost-sharing Reductions

Discounts that reduce the amount you pay for certain services covered by an individual plan you buy through the Marketplace. You may get a discount if your income is below a certain level, and you choose a Silver level health plan or if you’re a member of a federally- recognized tribe, which includes being a shareholder in an Alaska Native Claims Settlement Act corporation.

Deductible

An amount you could owe during a coverage period (usually one year) for covered health care services before your plan begins to pay. An overall deductible applies to all or almost all covered items and services. A plan with an overall deductible may also have separate deductibles that apply to specific services or groups of services. A plan may also have only separate deductibles. (For example, if your deductible is $1000, your plan won’t pay anything until you’ve met your $1000 deductible for covered health care services subject to the deductible.)

Diagnostic Test

Tests to figure out what your health problem is. For example, an x-ray can be a diagnostic test see if you have a broken bone.

Durable Medical Equipment (DME)

Equipment and supplies ordered by a health care provider for everyday or extended use. DME may include: oxygen equipment, wheelchairs, and crutches.

Emergency Medical Condition

An illness, injury, symptom (including severe pain), or condition severe enough to risk serious danger to your health if you didn’t get medical attention right away. If you didn’t get immediate medical attention you could reasonably expect one of the following: 1) Your health would be put in serious danger; or 2) You would have serious problems with your bodily functions; or 3) You would have serious damage to any part or organ of your body.

Emergency Medical Transportation

Ambulance services for an emergency medical condition. Types of emergency medical transportation may include transportation by air, land, or sea. Your plan may not cover all types of emergency medical transportation, or may pay less for certain types.

Emergency Room Care / Emergency Services Services to check for an emergency medical condition and treat you to keep an emergency medical condition from getting worse. These services may be provided in a licensed hospital’s emergency room or other place that provides care for emergency medical conditions.

Excluded Services

Health care services that your plan doesn’t pay for or cover.

Formulary

A list of drugs your plan covers. A formulary may include how much your share of the cost is for each drug. Your plan may put drugs in different cost-sharing levels or tiers. For example, a formulary may include generic drug and brand name drug tiers and different cost- sharing amounts will apply to each tier.

Grievance

A complaint that you communicate to your health insurer or plan.

Habilitation Services

Health care services that help a person keep, learn or improve skills and functioning for daily living. Examples include therapy for a child who isn’t walking or talking at the expected age. These services may include physical and occupational therapy, speech-language pathology, and other services for people with disabilities in a variety of inpatient and/or outpatient settings.

Home Health Care

Health care services and supplies you get in your home under your doctor’s orders. Services may be provided by nurses, therapists, social workers, or other licensed health care providers. Home health care usually doesn’t include help with non-medical tasks, such as cooking, cleaning, or driving.

Health Insurance

A contract that requires a health insurer to pay some or all of your health care costs in exchange for a premium. A health insurance contract may also be called a “policy” or “plan.”

Hospice Services

Services to provide comfort and support for persons in the last stages of a terminal illness and their families.

Hospitalization

Care in a hospital that requires admission as an inpatient and usually requires an overnight stay. Some plans may consider an overnight stay for observation as outpatient care instead of inpatient care.

Hospital Outpatient Care

Care in a hospital that usually doesn’t require an overnight stay.

In-network Coinsurance

Your share (for example, 20%) of the allowed amount for covered health care services. Your share is usually lower for in-network covered services.

In-network Copayment

A fixed amount (for example, $15) you pay for covered health care services to providers who contract with your health insurance or plan. In-network copayments usually are less than out-of-network copayments.

Marketplace

A marketplace for health insurance where individuals, families and small businesses can learn about their plan options; compare plans based on costs, benefits and other important features; apply for and receive financial help with premiums and cost sharing based on income; and choose a plan and enroll in coverage. Also known as an “Exchange.” The Marketplace is run by the state in some states and by the federal government in others. In some states, the Marketplace also helps eligible consumers enroll in other programs, including Medicaid and the Children’s Health Insurance Program (CHIP). Available online, by phone, and in-person.

Maximum Out-of-pocket Limit

Yearly amount the federal government sets as the most each individual or family can be required to pay in cost sharing during the plan year for covered, in-network services. Applies to most types of health plans and insurance. This amount may be higher than the out-of- pocket limits stated for your plan.

Medically Necessary

Health care services or supplies needed to prevent, diagnose, or treat an illness, injury, condition, disease, or its symptoms, including habilitation, and that meet accepted standards of medicine.

Minimum Value Standard

A basic standard to measure the percent of permitted costs the plan covers. If you’re offered an employer plan that pays for at least 60% of the total allowed costs of benefits, the plan offers minimum value and you may not qualify for premium tax credits and cost-sharing reductions to buy a plan from the Marketplace.

Network

The facilities, providers and suppliers your health insurer or plan has contracted with to provide health care services.

Network Provider (Preferred Provider)

A provider who has a contract with your health insurer or plan who has agreed to provide services to members of a plan. You will pay less if you see a provider in the network. Also called “preferred provider” or “participating provider.”

Orthotics and Prosthetics

Leg, arm, back and neck braces, artificial legs, arms, and eyes, and external breast prostheses after a mastectomy. These services include: adjustment, repairs, and replacements required because of breakage, wear, loss, or a change in the patient’s physical condition.

Out-of-network Coinsurance

Your share (for example, 40%) of the allowed amount for covered health care services to providers who don’t contract with your health insurance or plan. Out-of- network coinsurance usually costs you more than in- network coinsurance.

Out-of-network Copayment

A fixed amount (for example, $30) you pay for covered health care services from providers who do not contract with your health insurance or plan. Out-of-network copayments usually are more than in-network copayments.

Out-of-network Provider (Non-Preferred Provider)

A provider who doesn’t have a contract with your plan to provide services. If your plan covers out-of-network services, you’ll usually pay more to see an out-of-network provider than a preferred provider. Your policy will explain what those costs may be. May also be called “non-preferred” or “non-participating” instead of “out- of-network provider.”

Out-of-pocket Limit

The most you could pay during a coverage period (usually one year) for your share of the costs of covered services. After you meet this limit the plan will usually pay 100% of the allowed amount. This limit helps you plan for health care costs. This limit never includes your premium, balance-billed charges or health care your plan doesn’t cover. Some plans don’t count all of your copayments, deductibles, coinsurance payments, out-of- network payments, or other expenses toward this limit.

Physician Services

Health care services a licensed medical physician, including an M.D. (Medical Doctor) or D.O. (Doctor of Osteopathic Medicine), provides or coordinates.

Plan

Health coverage issued to you directly (individual plan) or through an employer, union or other group sponsor (employer group plan) that provides coverage for certain health care costs. Also called “health insurance plan,” “policy,” “health insurance policy,” or “health insurance.”

Pre-authorization/Pre-certification

A decision by your health insurer or plan that a health care service, treatment plan, prescription drug or durable medical equipment (DME) is medically necessary. Sometimes called “prior authorization,” “prior approval,” or “pre-certification.” Your health insurance or plan may require pre-authorization for certain services before you receive them, except in an emergency. Pre-authorization isn’t a promise your health insurance or plan will cover the cost.

Premium

The amount that must be paid for your health insurance or plan. You and/or your employer usually pay it monthly, quarterly, or yearly.

Premium Tax Credits

Financial help that lowers your taxes to help you and your family pay for private health insurance. You can get this help if you get health insurance through the Marketplace and your income is below a certain level. Advance payments of the tax credit can be used right away to lower your monthly premium costs.

Prescription Drug Coverage

Coverage under a plan that helps pay for prescription drugs. If the plan’s formulary uses “tiers” (levels), prescription drugs are grouped together by type or cost. The amount you’ll pay in cost sharing will be different for each “tier” of covered prescription drugs.

Prescription Drugs

Drugs and medications that by law require a prescription.

Preventive Care (Preventive Service)

Routine health care, including screenings, check-ups, and patient counseling, to prevent or discover illness, disease, or other health problems.

Primary Care Physician

A physician, including an M.D. (Medical Doctor) or D.O. (Doctor of Osteopathic Medicine), who provides or coordinates a range of health care services for you.

Primary Care Provider

A physician, including an M.D. (Medical Doctor) or D.O. (Doctor of Osteopathic Medicine), nurse practitioner, clinical nurse specialist, or physician assistant, as allowed under state law and the terms of the plan, who provides, coordinates, or helps you access a range of health care services.

Provider

An individual or facility that provides health care services. Some examples of a provider include a doctor, nurse, chiropractor, physician assistant, hospital, surgical center, skilled nursing facility, and rehabilitation center. The plan may require the provider to be licensed, certified, or accredited as required by state law.

Reconstructive Surgery

Surgery and follow-up treatment needed to correct or improve a part of the body because of birth defects, accidents, injuries, or medical conditions.

Referral

A written order from your primary care provider for you to see a specialist or get certain health care services. In many health maintenance organizations (HMOs), you need to get a referral before you can get health care services from anyone except your primary care provider. If you don’t get a referral first, the plan may not pay for the services.

Rehabilitation Services

Health care services that help a person keep, get back, or improve skills and functioning for daily living that have been lost or impaired because a person was sick, hurt, or disabled. These services may include physical and occupational therapy, speech-language pathology, and psychiatric rehabilitation services in a variety of inpatient and/or outpatient settings.

Screening

A type of preventive care that includes tests or exams to detect the presence of something, usually performed when you have no symptoms, signs, or prevailing medical history of a disease or condition.

Skilled Nursing Care

Services performed or supervised by licensed nurses in your home or in a nursing home. Skilled nursing care is not the same as “skilled care services,” which are services performed by therapists or technicians (rather than licensed nurses) in your home or in a nursing home.

Specialist

A provider focusing on a specific area of medicine or a group of patients to diagnose, manage, prevent, or treat certain types of symptoms and conditions.

Specialty Drug

A type of prescription drug that, in general, requires special handling or ongoing monitoring and assessment by a health care professional, or is relatively difficult to dispense. Generally, specialty drugs are the most expensive drugs on a formulary.

UCR (Usual, Customary and Reasonable)

The amount paid for a medical service in a geographic area based on what providers in the area usually charge for the same or similar medical service. The UCR amount sometimes is used to determine the allowed amount.

Urgent Care

Care for an illness, injury, or condition serious enough that a reasonable person would seek care right away, but not so severe as to require emergency room care.

HIPAA Privacy and Security Policy

1. Purpose

This Privacy and Security Policy is designed to ensure compliance with the Health Insurance Portability and Accountability Act (HIPAA) and to safeguard the privacy and security of protected health information (PHI) maintained by Kalamazoo College.

2. Scope

This policy applies to all employees, volunteers, and any other individuals who have access to PHI within Kalamazoo College. Please Note: Contractors who come in control with PHI must be able to demonstrate completion of HIPAA training and provide a signed Business Associate’s Agreement for our files.

3. Privacy Policies

a. Use and Disclosure of PHI: PHI is only used or disclosed as permitted by HIPAA regulations and applicable state laws.

b. Minimum Necessary Standard: Access to PHI is limited to the minimum necessary to accomplish the intended purpose of the use, disclosure, or request.

c. Individual Rights: Individuals have the right to access, inspect, and request amendments to their PHI. Kalamazoo College provides individuals with a notice of privacy practices outlining their rights and how their PHI is used and disclosed.

d. Notice of Privacy Practices: Kalamazoo College maintains and distributes a Notice of Privacy Practices as required by HIPAA regulations.

Notice of Privacy Practices

Please review this notice carefully, as it describes how one or more of the health plans of Kalamazoo College (collectively the “Plan”) and any third party assisting in the administration of claims may use and disclose your health information, and how you can access this information. This notice is being provided to you pursuant to the federal law known as HIPAA and an amendment to that law known as HITECH and is effective January 1, 2015. If you have any questions about this notice, please contact Renee Boelcke, the Privacy Officer at Kalamazoo College, at 1200 Academy Street, Kalamazoo, Michigan 49006, or at Renee.Boelcke@kzoo.edu. The Plan has been amended to comply with the requirements described in this notice.

The Plan’s Pledge Regarding Health Information. The Plan is committed to protecting your personal health information. The Plan is required by law to protect medical information about you. This notice applies to medical records and information the Plan maintains concerning the Plan. Your personal doctor or health care provider may have different policies or notices regarding the use and disclosure of your health information created in his or her facility. This notice will describe how the Plan may use and disclose health information (known as “protected health information” under federal law) about you, as well as the Plan’s obligations and your rights regarding this use and disclosure.

Use and Disclosure of Health Information.

The following categories describe different ways that the Plan uses and discloses protected health information. The Plan will explain and present examples for each category but will not list every possible use or disclosure. However, all of the permissible uses and disclosures fall within one of these categories:

- For Treatment. The Plan may use or disclose your health information to facilitate treatment or services by providers. For example, the Plan may disclose your health information to providers, including doctors, nurses, or other hospital personnel who are involved in your care.

- For Payment. The Plan may use and disclose your health information to determine eligibility for Plan benefits, to facilitate payment for the treatment and services you receive from health care providers, or to determine benefit responsibility under the Plan. For example, the Plan may disclose your health history to your health care provider to determine whether a particular treatment is a qualifying health expense or to determine whether the Plan will reimburse the treatment. The Plan may also share your health information with a utilization review or pre-certification service provider, with another entity to assist with the adjudication or subrogation of health claims, or with another health plan to coordinate benefit payments.

- For Health Care Operations. The Plan may use and disclose your health information in order to operate the Plan. For example, the Plan may use health information in connection with the following: (1) quality assessment and improvement; (2) underwriting, premium rating, and Plan coverage; (3) stop-loss (or excess-loss) claim submission; (4) medical review, legal services, audit services, and fraud and abuse detection programs; (5) business planning and development, such as cost management; and (6) business management and general Plan administration.

- To Business Associates and Subcontractors. The Plan may contract with individuals and entities known as business associates to perform various functions or provide certain services. In order to perform these functions or provide these services, business associates may receive, create, maintain, use, or disclose your health information, but only after they sign an agreement with the Plan requiring them to implement appropriate safeguards regarding your health information. For example, the Plan may disclose your health information to a business associate to administer claims or to provide support services, but only after the business associate enters into a Business Associate Agreement with the Plan. Similarly, a business associate may hire a subcontractor to assist in performing functions or providing services in connection with the Plan. If a subcontractor is hired, the business associate may not disclose your health information to the subcontractor until after the subcontractor enters into a Subcontractor Agreement with the business associate.

- As Required by Law. The Plan will disclose your health information when required to do so by federal, state, or local law. For example, the Plan may disclose health information when required by a court order in a litigation proceeding, such as a malpractice action.

- To Avert a Serious Threat to Health or Safety. The Plan may use and disclose your health information when necessary to prevent a serious threat to the health and safety of you, another person, or the public. The Plan would disclose this information only to someone able to help prevent the threat. For example, the Plan may disclose your health information in a proceeding regarding the licensure of a physician.

- To Health Plan Sponsor. The Plan may disclose health information to another health plan maintained by the Plan sponsor for purposes of facilitating claims payments under that plan. In addition, the Plan may disclose your health information to the Plan sponsor and its personnel for purposes of administering benefits under the Plan or as otherwise permitted by law and the Plan sponsor’s HIPAA privacy policies and procedures.

Special Situations.

The Plan may also use and disclose your protected health information in the following special situations:

- Organ and Tissue Donation. The Plan may release health information to organizations that handle organ procurement or organ, eye, or tissue transplantation or to an organ donation bank as necessary to facilitate organ or tissue donation and transplantation.

- Military and Veterans. If you are a member of the armed forces, the Plan may release your health information as required by military command authorities. The Plan may also release health information about foreign military personnel to the appropriate foreign military authority.

- Workers’ Compensation. The Plan may release health information for Workers’ Compensation or similar programs that provide benefits for work-related injuries or illnesses.

- Public Health Risks. The Plan may disclose health information for public health activities, such as prevention or control of disease, injury, or disability; report of births and deaths; and notification of disease exposure or risk of disease contraction or proliferation.

- Health Oversight Activities. The Plan may disclose health information to a health oversight agency for activities authorized by law, e.g., audits, investigations, inspections, and licensure, which are necessary for the government to monitor the health care system, government programs, and compliance with civil rights laws.

- Law Enforcement. The Plan may release health information if requested by a law enforcement official in the following circumstances: (1) in response to a court order, subpoena, warrant, or summons; (2) to identify or locate a suspect, fugitive, material witness, or missing person; (3) to report a crime; and (4) to disclose information about the victim of a crime if (under certain limited circumstances) the Plan is unable to obtain the person’s agreement.

- Coroners and Medical Examiners. The Plan may release health information to a coroner or medical examiner if necessary (e.g., to identify a deceased person or determine the cause of death).

Rights Regarding Health Information.

You have the following rights regarding your protected health information that the Plan maintains:

- Right to Access. You may request access to health information containing your enrollment, payment, and other records used to make decisions about your Plan benefits, including the right to inspect the information and the right to a copy of the information. You may request that the information be sent to a third party. You must submit a request for access in writing to the Privacy Officer. The Plan may charge a fee for the costs of copying, mailing, or other supplies associated with your request. The Plan may deny your request in certain very limited circumstances, and you may request that such denial be reviewed. If the Plan maintains your health information electronically in a designated record set, the Plan will provide you with access to the information in the electronic form and format you request if readily producible or, if not, in a readable electronic form and format as agreed to by the Plan and you.

- Right to Amend. If you feel that the Plan’s records of your health information are incorrect or incomplete, you may request an amendment to the information for as long as the information is kept by or for the Plan. You must submit a request for amendment in writing to the Privacy Officer. Your written request must include a supporting reason; otherwise the Plan may deny your request for an amendment. In addition, the Plan may deny your request to amend information that is not part of the health information kept by or for the Plan, was not created by the Plan (unless the person or entity that created the information is no longer available to make the amendment), is not part of the information that you would be permitted to inspect and copy, or is accurate and complete.

- Right to an Accounting of Disclosures. You may request an accounting of your health information disclosures except disclosures for treatment, payment, health care operations; disclosures to you about your own health information; disclosures pursuant to an individual authorization; or other disclosures as set forth in the Plan sponsor’s HIPAA privacy policies and procedures. You must submit a request for accounting in writing to the Privacy Officer. Your request must state a time period for the accounting not longer than six years and indicate your preferred form (e.g., paper or electronic). The Plan will provide for free the first accounting you request within a 12-month period, but the Plan may charge you for the costs of providing additional lists (the Plan will notify you prior to provision and you may cancel your request). Effective at the time prescribed by federal regulations, you may also request an accounting of uses and disclosures of your health information maintained as an electronic health record if the Plan maintains such records.

- Right to Request Restrictions. You may request a restriction or limitation on your health information that the Plan uses or discloses for treatment, payment, or health care operations or that the Plan discloses to someone involved in your care or the payment for your care (e.g., a family member or friend). For example, you could ask that the Plan not use or disclose information about a surgery you had. You must submit a request for restriction in writing to the Privacy Officer. Your request must describe what information you want to limit; whether you want to limit the Plan’s use, disclosure, or both; and to whom you want the limits to apply (e.g., your spouse). The Plan is not required to agree to your request.

- Right to Request Confidential Communications. You may request that the Plan communicate with you about health matters in a certain way or at a certain location (e.g., only by mail or at work), and the Plan will accommodate all reasonable requests. You must submit a request for confidential communications in writing to the Privacy Officer. Your written request must specify how or where you wish to be contacted. You do not need to state the reason for your request.

- Right to a Paper Copy of this Notice. If you received this notice electronically, you may receive a paper copy at any time by contacting the Privacy Officer.

Genetic Information.

If the Plan uses or discloses protected health information for Plan underwriting purposes, the Plan will not (except in the case of any long-term care benefits) use or disclose health information that is your genetic information for such purposes.

Breach Notification Requirements.

In the event unsecured protected health information about you is “breached,” the Plan will notify you of the situation unless the Plan determines the probability is low that the health information has been compromised. The Plan will also inform HHS of the breach and take any other steps required by law.

Changes to this Notice.

The Plan reserves the right to revise or change this notice, which may be effective for your protected health information the Plan already possesses as well as any information the Plan receives in the future. The Plan will notify you if this notice changes.

Complaints.

If you believe your privacy rights have been violated, you may file a complaint with the Plan by contacting the Privacy Officer in writing. You may also file a written complaint with the Secretary of the U.S. Department of Health and Human Services. You will not be penalized for filing a complaint.

Other Uses of Health Information.

The Plan will use and disclose protected health information not covered by this notice or applicable laws only with your written permission. If you permit the Plan to use or disclose your health information, you may revoke that permission, in writing, at any time. If you revoke your permission, the Plan will no longer use or disclose your health information for the reasons covered by your written authorization. However, the Plan is unable to retract any disclosures it has already made with your permission.

4. Security Policies

a. Administrative Safeguards: Kalamazoo College utilizes administrative safeguards, including security management processes, workforce training, and contingency planning, to protect the confidentiality, integrity, and availability of PHI.

b. Physical Safeguards: Kalamazoo College utilizes physical safeguards, such as facility access controls and workstation security, to protect electronic PHI (ePHI) and physical records containing PHI.

c. Technical Safeguards: Kalamazoo College utilizes technical safeguards, including access controls, encryption, and audit controls, to protect ePHI stored or transmitted electronically.

d. Breach Notification: Kalamazoo College utilizes established procedures for responding to and mitigating breaches of unsecured PHI, including notifying affected individuals, the Secretary of Health and Human Services, and, if necessary, the media – in the event of a breach affecting 500 or more individuals in a specific state or jurisdiction.

5. Compliance

a. Monitoring and Enforcement: Kalamazoo College monitors compliance with this policy and takes appropriate disciplinary action against individuals who violate HIPAA regulations or organizational policies.

b. Training: Kalamazoo College provides HIPAA training to all employees, and volunteers who have access to PHI, and ensure that they understand their responsibilities for protecting PHI. Constractors must produce their Business Associate Agreement or demonstrate completion of HIPAA training.

6. Documentation and Recordkeeping

Kalamazoo College maintains documentation of its HIPAA compliance efforts, including policies and procedures, training records, risk assessments, and breach response activities.

7. Review and Revision

This policy will be reviewed periodically and updated as necessary to reflect changes in HIPAA regulations, organizational operations, or the security landscape.

8. Contact Information

For questions or concerns regarding this policy or HIPAA compliance, please contact the Privacy Officer, Renee Boelcke, at 269.337.7248.

Process: Reporting HIPAA Violations