You can enroll in a Marketplace health insurance plan during the annual Marketplace Open Enrollment Period. Open Enrollment varies by state but generally starts November 1 and continues through at least December 15.

Outside the annual Open Enrollment Period, you can sign up for health insurance if you qualify for a Special Enrollment Period. In general, you qualify for a Special Enrollment Period if you’ve had certain qualifying life events, such as getting married, having a baby, adopting a child, or losing eligibility for other health coverage. Depending on your Special Enrollment Period type, you may have 60 days before or 60 days following the qualifying life event to enroll in a Marketplace plan.

PART A: General Information

Even if you are offered health coverage through your employment, you may have other coverage options through the Health Insurance Marketplace (“Marketplace”). To assist you as you evaluate options for you and your family, this notice provides some basic information about the Health Insurance Marketplace and health coverage offered through your employment.

What is the Health Insurance Marketplace?

The Marketplace is designed to help you find health insurance that meets your needs and fits your budget. The Marketplace offers “one-stop shopping” to find and compare private health insurance options in your geographic area.

Can I Save Money on my Health Insurance Premiums in the Marketplace?

You may qualify to save money and lower your monthly premium and other out-of-pocket costs, but only if your employer does not offer coverage, or offers coverage that is not considered affordable for you and doesn’t meet certain minimum-value standards (discussed below). The savings that you’re eligible for depends on your household income. You may also be eligible for a tax credit that lowers your costs.

Does Employer Health Coverage Affect Eligibility for Premium Savings through the Marketplace?

Yes. If you have an offer of health coverage from your employer that is considered affordable for you and meets certain minimum-value standards, you will not be eligible for a tax credit, or advance payment of the tax credit, for your Marketplace coverage and may wish to enroll in your employment-based health plan. However, you may be eligible for a tax credit, and advance payments of the credit that lowers your monthly premium, or a reduction in certain cost-sharing, if your employer does not offer coverage to you at all or does not offer coverage that is considered affordable for you or meet minimum-value standards. If your share of the premium cost of all plans offered to you through your employment is more than 9.12%1 of your annual household income, or if the coverage through your employment does not meet the “minimum-value” standard set by the Affordable Care Act, you may be eligible for a tax credit, and advance payment of the credit, if you do not enroll in the employment-based health coverage. For family members of the employee, coverage is considered affordable if the employee’s cost of premiums for the lowest-cost plan that would cover all family members does not exceed 9.12% of the employee’s household income.2

Note: If you purchase a health plan through the Marketplace instead of accepting health coverage offered through your employment, then you may lose access to whatever the employer contributes to the employment-based coverage. Also, this employer contribution -as well as your employee contribution to employment-based coverage- is generally excluded from income for federal and state income tax purposes. Your payments for coverage through the Marketplace are made on an after-tax basis. In addition, note that if the health coverage offered through your employment does not meet the affordability or minimum-value standards, but you accept that coverage anyway, you will not be eligible for a tax credit. You should consider all of these factors in determining whether to purchase a health plan through the Marketplace.

When Can I Enroll in Health Insurance Coverage through the Marketplace?

You can enroll in a Marketplace health insurance plan during the annual Marketplace Open Enrollment Period. Open Enrollment varies by state but generally starts November 1 and continues through at least December 15.

Outside the annual Open Enrollment Period, you can sign up for health insurance if you qualify for a Special Enrollment Period. In general, you qualify for a Special Enrollment Period if you’ve had certain qualifying life events, such as getting married, having a baby, adopting a child, or losing eligibility for other health coverage. Depending on your Special Enrollment Period type, you may have 60 days before or 60 days following the qualifying life event to enroll in a Marketplace plan.

There is also a Marketplace Special Enrollment Period for individuals and their families who lose eligibility for Medicaid or Children’s Health Insurance Program (CHIP) coverage on or after March 31, 2023, through July 31, 2024. Since the onset of the nationwide COVID-19 public health emergency, state Medicaid and CHIP agencies generally have not terminated the enrollment of any Medicaid or CHIP beneficiary who was enrolled on or after March 18, 2020, through March 31, 2023. As state Medicaid and CHIP agencies resume regular eligibility and enrollment practices, many individuals may no longer be eligible for Medicaid or CHIP coverage starting as early as March 31, 2023. The U.S. Department of Health and Human Services is offering a temporary Marketplace Special Enrollment period to allow these individuals to enroll in Marketplace coverage.

Marketplace-eligible individuals who live in states served by HealthCare.gov and either- submit a new application or update an existing application on HealthCare.gov between March 31, 2023 and July 31, 2024, and attest to a termination date of Medicaid or CHIP coverage within the same time period, are eligible for a 60-day Special Enrollment Period. That means that if you lose Medicaid or CHIP coverage between March 31, 2023, and July 31, 2024, you may be able to enroll in Marketplace coverage within 60 days of when you lost Medicaid or CHIP coverage. In addition, if you or your family members are enrolled in Medicaid or CHIP coverage, it is important to make sure that your contact information is up to date to make sure you get any information about changes to your eligibility. To learn more, visit HealthCare.gov or call the Marketplace Call Center at 1-800-318-2596. TTY users can call 1-855-889-4325.

What about Alternatives to Marketplace Health Insurance Coverage?

If you or your family are eligible for coverage in an employment-based health plan (such as an employer-sponsored health plan), you or your family may also be eligible for a Special Enrollment Period to enroll in that health plan in certain circumstances, including if you or your dependents were enrolled in Medicaid or CHIP coverage and lost that coverage. Generally, you have 60 days after the loss of Medicaid or CHIP coverage to enroll in an employment-based health plan, but if you and your family lost eligibility for Medicaid or CHIP coverage between March 31, 2023 and July 10, 2023, you can request this special enrollment in the employment-based health plan through September 8, 2023. Confirm the deadline with your employer or your employment-based health plan.

Alternatively, you can enroll in Medicaid or CHIP coverage at any time by filling out an application through the Marketplace or applying directly through your state Medicaid agency. Visit https://www.healthcare.gov/medicaid-chip/getting-medicaid-chip/ for more details.

How Can I Get More Information?

For more information about your coverage offered by your employer, please check your summary plan description or contact ASR Health Benefits at 800.968.2449.

The Marketplace can help you evaluate your coverage options, including your eligibility for coverage through the Marketplace and its cost. Please visit HealthCare.gov for more information, including an online application for health insurance coverage and contact information for a Health Insurance Marketplace in your area.

PART B: Information About Health Coverage Offered by Your Employer

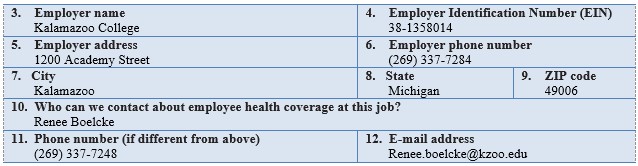

This section contains information about any health coverage offered by your employer. If you decide to complete an application for coverage in the Marketplace, you will be asked to provide this information. This information is numbered to correspond to the Marketplace application.

Here is some basic information about health coverage offered by this employer:

- As your employer, we offer a health plan to: Some employees. Eligible employees are:

Individuals working in full-time employment for at least 40 hours or more per week or part-time employment for at least 20 hours or more per week. Such individuals must complete any required waiting period for plan coverage and must submit any required application for health plan coverage on a form that is acceptable to the employer.

- With respect to dependents: We do offer coverage. Eligible dependents are:

- The employee’s legal spouse. However, working spouses with other available employer- based coverage are generally not eligible to enroll for coverage under the plan (an exception based on the spouse’s share of the premium cost may apply).

- The employee’s domestic partner (some restrictions apply). However, working domestic partners with other available employer-based coverage are generally not eligible to enroll for coverage under the plan (an exception based on the domestic partner’s share of the premium cost may apply).

- The employee’s or enrolled domestic partner’s natural child, stepchild, legally adopted child, or a child placed with the employee or domestic partner for adoption (age limits apply).

- A child who has been placed under the legal guardianship of the employee or enrolled domestic partner and is considered a “dependent” of the employee or domestic partner for tax exemption purposes under Section 152 of the Internal Revenue Code of 1986, as amended (age limits apply).

- A child for whom the employee or enrolled domestic partner is obligated to provide medical care coverage under an order or judgment of a court of competent jurisdiction and could be considered a “dependent” of the employee for tax exemption purposes under Section 152 of the Internal Revenue Code of 1986, as amended (age limits apply).

- A child for whom the employee or enrolled domestic partner is obligated to provide medical coverage under a Qualified Medical Child Support Order (age limits apply).

X If checked, this coverage meets the minimum-value standard, and the cost of this coverage to you is intended to be affordable, based on employee wages.

Even if your employer intends your coverage to be affordable, you may still be eligible for a premium discount through the Marketplace. The Marketplace will use your household income, along with other factors, to determine whether you may be eligible for a premium discount. If, for example, your wages vary from week to week (perhaps you are an hourly employee or you work on a commission basis), if you are newly employed midyear, or if you have other income losses, you may still qualify for a premium discount.

If you decide to shop for coverage in the Marketplace, HealthCare.gov will guide you through the process. Here’s the employer information you’ll enter when you visit HealthCare.gov to find out if you can get a tax credit to lower your monthly premiums.

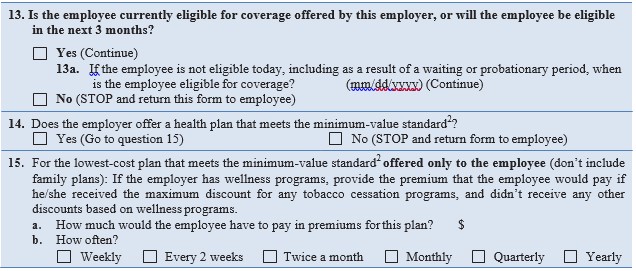

The information below corresponds to the Marketplace Employer Coverage Tool. Completing this section is optional for employers, but will help ensure employees understand their coverage choices.

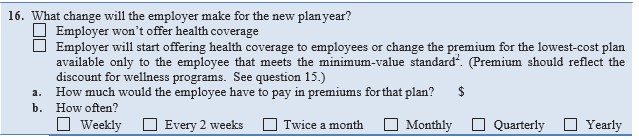

If the plan year will end soon and you know that the health plans offered will change, go to question 16. If you don’t know, STOP and return form to employee.

- Indexed annually; see https://www.irs.gov/pub/irs-drop/rp-22-34.pdf for 2023.

- An employer-sponsored or other employment-based health plan meets the “minimum-value standard” if the plan’s share of the total allowed benefit costs covered by the plan is no less than 60 percent of such costs. For purposes of eligibility for the premium tax credit, to meet the “minimum-value standard,” the health plan must also provide substantial coverage of both inpatient hospital services and physician services.

- An employer-sponsored health plan meets the “minimum-value standard” if the plan’s share of the total allowed benefit costs covered by the plan is no less than 60 percent of such costs (Section 36B(c)(2)(C)(ii) of the Internal Revenue Code of 1986).